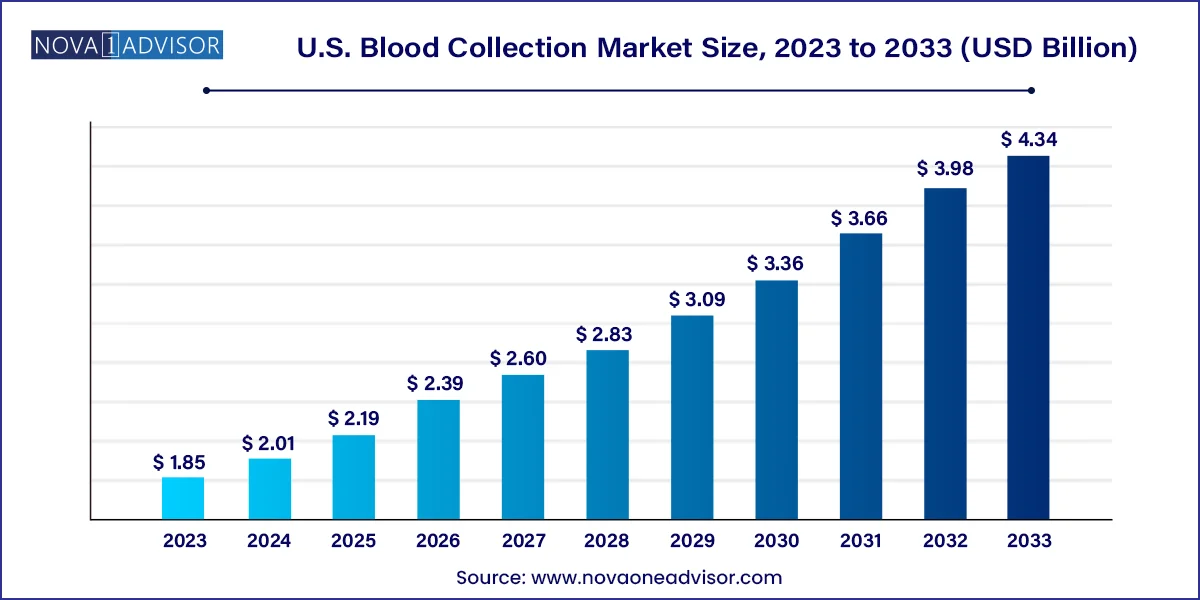

The U.S. blood collection market size was USD 1.85 billion in 2023, calculated at USD 2.01 billion in 2024 and is expected to reach around USD 4.34 billion by 2033, expanding at a CAGR of 8.9% from 2024 to 2033.

The U.S. blood collection market is a vital pillar of the national healthcare infrastructure, serving as a backbone for both diagnostic and therapeutic applications across hospitals, laboratories, blood banks, and mobile health units. Blood collection, encompassing the procurement of whole blood and its components, plays an indispensable role in disease diagnosis, transfusions, organ transplantation, trauma management, cancer treatment, and chronic condition monitoring. As the U.S. healthcare system transitions toward preventive medicine and value-based care, the accuracy and efficiency of blood collection technologies have gained new significance.

In 2024, the U.S. blood collection ecosystem has expanded beyond traditional hospital settings to include mobile services, point-of-care clinics, and community blood drives. Increasing chronic disease burden, aging demographics, and growing healthcare access in rural regions have spurred demand for advanced, reliable, and minimally invasive blood collection techniques. The rise of home-based diagnostics and wearable health solutions has further diversified the methods and frequency of blood sampling.

Market stakeholders—from device manufacturers to government health agencies—have also been influenced by the recent COVID-19 pandemic, which exposed vulnerabilities in the national blood supply chain. In response, innovations in cold-chain logistics, plasma separation technologies, and closed-loop automated blood collection systems are being rapidly adopted. Furthermore, public awareness campaigns and donor retention initiatives are being revitalized, especially in underserved states, to ensure a resilient national blood system.

Adoption of Safety-Engineered Devices: Increasing demand for needle-stick injury prevention and closed-system collection kits is transforming product design.

Rise of Mobile Blood Collection Units: Community outreach and telehealth integrations have boosted mobile collection services, especially in rural and underserved areas.

Automation in Blood Processing: Integration of automated blood separation, labeling, and testing systems within collection centers to enhance throughput and safety.

Micro-Sampling Technologies: Growing use of lancets, micro-containers, and capillary devices for pediatric and at-home diagnostics.

Increased Demand for Plasma-Derived Therapies: Expansion in plasma collection tubes and bags due to rising immunoglobulin-based treatments.

Integration of Digital Tracking & Inventory Systems: Use of RFID, barcoding, and real-time tracking software in managing blood units across hospitals and banks.

Customization for Pediatric and Geriatric Needs: Development of age-appropriate needles, containers, and warming devices for better compliance and comfort.

Public-Private Collaborations: Government-supported partnerships with healthcare providers and NGOs to stabilize national blood supplies.

| Report Attribute | Details |

| Market Size in 2025 | USD 2.19 Billion |

| Market Size by 2033 | USD 4.34 Billion |

| Growth Rate From 2024 to 2033 | CAGR of 8.9% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | Site, application, end use, age, demography, states |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Key Companies Profiled | Sekisui Medical Co., Ltd., Becton, Dickinson and Company (BD), Greiner Bio-One, QIAGEN, Nipro Corporation, Terumo Corporation, Haemonetics Corp., Zhejiang Gongdong Medical Technology Co., Ltd., Drucker Diagnostics, AdvaCare Pharma |

A primary driver of growth in the U.S. blood collection market is the increasing prevalence of chronic conditions—such as cancer, anemia, hemophilia, and renal disease—that necessitate regular blood transfusions and diagnostics. According to CDC data, over 60% of Americans suffer from at least one chronic illness, creating sustained demand for both venous and capillary blood collection. Additionally, the U.S. sees a high volume of elective and emergency surgeries annually, most of which require preoperative and postoperative blood testing or transfusion support. This has led to an increased need for efficient, safe, and standardized blood collection protocols in both inpatient and outpatient settings.

Despite medical advancements, one of the most persistent challenges remains the shortage of eligible blood donors, particularly during public health emergencies or natural disasters. Seasonal fluctuations in donor turnout, pandemic fears, and geographic disparities in blood availability often result in critical shortages. The American Red Cross has highlighted that blood inventory frequently falls below the minimum threshold, particularly for rare blood types. Furthermore, complex storage, handling, and transportation requirements—especially for plasma and platelets—make it difficult to maintain a consistent supply across all states, particularly in remote or underserved regions.

As healthcare delivery models shift toward decentralization, there’s a growing opportunity for capillary blood collection tools that enable testing at home, in retail clinics, or remote locations. The expansion of telehealth and self-testing kits has created a fertile market for lancets, micro-collection tubes, and warming devices that simplify blood collection for non-clinical users. Emerging technologies such as volumetric absorptive microsampling (VAMS) are gaining traction, offering accurate sampling with minimal invasiveness. This trend is particularly relevant for chronic disease monitoring, prenatal screening, and infectious disease surveillance, opening up a new segment of end-users who demand convenience without compromising on sample integrity.

Venous blood collection dominated the U.S. market, accounting for the majority of diagnostic and transfusion-related procedures. The segment encompasses a wide range of devices such as double-ended needles, blood collection tubes (serum-separating, EDTA, heparin), and blood bags. Venipuncture remains the gold standard in hospital and laboratory settings due to its ability to yield high-volume samples suitable for multi-panel tests and component separation. Moreover, advances in vacuum-assisted collection tubes and safety-engineered needles have enhanced collection efficiency and minimized contamination and exposure risks.

Capillary blood collection is the fastest-growing site segment, driven by the rise of decentralized diagnostics and pediatric applications. Tools like lancets, micro-hematocrit tubes, and warming devices are gaining favor in point-of-care testing, home diagnostics, and mobile clinics. These tools are ideal for quick glucose testing, hemoglobin evaluation, and disease marker screening in infants and the elderly. The growing demand for less invasive methods and faster turnaround in outpatient settings has led companies like SARSTEDT and Greiner Bio-One to launch user-friendly capillary blood collection kits with integrated stabilization features.

Diagnostics lead the application segment, owing to the high frequency of routine blood tests, disease screenings, and pre-surgical assessments performed across the healthcare ecosystem. Every year, millions of diagnostic tests in the U.S. depend on venous and capillary blood samples to monitor cholesterol, glucose, hormones, infections, and organ function. This has spurred consistent demand for high-accuracy tubes, sample preservation systems, and vacuum-assisted syringes. The increased emphasis on early disease detection and regular health monitoring has amplified the significance of diagnostic blood collection.

Treatment-related applications are growing rapidly, especially with the increasing use of blood and plasma therapies for chronic disease management and emergency care. Transfusions for trauma victims, cancer patients, and surgical recipients rely on timely and safe collection of compatible blood units. Blood bags and component separation kits are in higher demand, particularly in oncology, nephrology, and cardiovascular wards. This segment also benefits from innovations in pathogen inactivation and automated blood bag systems, ensuring higher safety and process control.

Hospitals are the dominant end-use segment, being the primary site for inpatient diagnostics, surgical procedures, and transfusions. They require a vast inventory of blood collection tools—from hypodermic needles to blood bags—along with integrated information systems for tracking samples. With increasing patient admissions and critical care procedures, hospitals continue to procure large quantities of blood collection consumables and automated systems to streamline diagnostics and treatment.

Mobile services and emergency departments are emerging as the fastest-growing users, thanks to the expansion of community outreach and disaster response capabilities. Mobile blood collection vehicles equipped with portable centrifuges, donor beds, and digital monitoring systems are serving rural populations and urban centers alike. Similarly, emergency departments depend on fast, reliable blood collection for trauma care and accident victims. Companies like Terumo and Haemonetics are innovating mobile-ready blood collection systems with closed-loop safety and digital traceability.

The 19 to 65 age group leads the market, representing the largest donor pool and highest recipient group for diagnostic tests and surgeries. Adults in this demographic undergo frequent screenings, chronic disease monitoring, and organ function testing, necessitating regular blood sampling. Blood collection products in this age group emphasize efficiency, speed, and compatibility with high-throughput analyzers.

The 66 years and above group is witnessing faster growth, reflecting aging population trends and higher disease burden. Geriatric patients often require transfusions for anemia, surgical support, and palliative care, increasing the need for safe and minimally invasive collection tools. Specially designed needles and warming devices are being developed to address fragile veins and coagulation issues in the elderly.

Urban populations dominate the market, due to higher healthcare access, frequent hospital visits, and concentration of diagnostic labs. Urban healthcare facilities adopt the latest blood collection technologies and maintain larger inventories, supporting fast-paced diagnostic and treatment needs.

Rural segments are growing faster, propelled by mobile collection units, state health programs, and rising penetration of community clinics. Partnerships between NGOs and state governments have enabled door-to-door collection initiatives and rural blood drives using portable devices and real-time data tracking systems.

The U.S. blood collection market is shaped by its highly decentralized yet advanced healthcare system. Federal agencies like the FDA and CDC regulate blood safety, while nonprofit organizations like the American Red Cross and AABB play critical roles in operationalizing donation drives and managing blood supplies. Technological innovation is centered in major hubs like California, Massachusetts, and New Jersey, where companies test and launch new products.

Nationwide trends reflect increased investments in public health infrastructure, modernization of blood bank technologies, and enhanced donor management systems. Geographic disparities in access and supply chain capacity are being addressed through state-level programs and federal funding, especially in the Southeast and Midwest. The U.S. market is also a testbed for next-gen blood collection products, including microfluidic sampling, AI-enabled tracking, and drone-based transportation in emergency scenarios.

April 2025 – Becton Dickinson (BD) introduced its new BD Vacutainer® UltraSafe capillary collection system, designed for rapid blood draws in pediatric and homecare settings.

March 2025 – Haemonetics Corporation announced FDA clearance for its NexSys PCS® plasma collection system, enabling faster plasma yields for immunoglobulin therapy.

January 2025 – Grifols partnered with a network of U.S. mobile clinics to enhance plasma collection capabilities across rural areas using portable centrifugation devices.

November 2024 – Terumo BCT launched its Trima Accel® 3.0 blood component collection platform in select U.S. states, enhancing component separation efficiency.

September 2024 – Greiner Bio-One opened a new manufacturing facility in North Carolina to increase domestic production of blood collection tubes and safety needles

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the U.S. Blood Collection market.

By Site

By Application

By End Use

By Age

By Demography

By States